2023. July 07.

Two teams from BME and MNB have competed in a competition focusing on the application possibilities of central bank digital currencies, mainly for tech companies. One of the teams have made it to the finals.

Project Rosalind Techsprint, a technology competition focusing on alternatives provided by the use of central bank digital currencies, invited solutions from international technology companies.

Within the framework of the BME–MNB cooperation, blockchain experts of the University of Technology and Economics and employees of MNB's digitalisation department have entered the competition – requiring serious professional knowledge – with two joint teams. One of the Hungarian teams have even made it to the finals.

The Project Rosalind Techsprint technology competition was launched by the London headquarters of the BIS Innovation Hub (Editor’s note: Bank for International Settlements, the world's oldest international financial institution still in operation. The central bank of central banks, the main organiser of monetary cooperation between international banks.) in February, 2023.

This year's objectives of the Innovation Hub include exploring the potential of central bank digital currencies (CBDCs), the future of financial regulation and supervision, and the security of and green solutions for the financial sector.

The Project Rosalind Techsprint aims to find ways to use central bank digital currency for the retail sector that encourage competition through collaboration between the private sector and the central bank, while adding value for users through new functionalities. In the competition, contestants had to first come up with ideas and later demonstrate a working system developed in the competition, linked to the BIS technology infrastructure. They were asked to come up with concrete proposals on how the digital money issued by the central bank could be used to solve public policy problems using new technological solutions.

One of the groups of BME-MNB have created a real-time, blockchain-based, hypothetical energy price subsidy and incentive scheme. In almost all European countries, government subsidies have been used to cushion the shock of the sudden rise in energy costs. The BME-MNB team have developed a flexible, adaptive, real-time solution to this very timely issue. It can serve a wide range of legal circumstances and expectations. If the government subsidises the consumer (e.g. households) up to a certain part of the energy bill, the subsidy is only available if the consumer pays their share of the bill. However, the energy supplier should not know whether a subsidy is included (and if it is, how much) when settling the bill. In a blockchain-based central bank digital currency solution, the organization providing the subsidy does not transfer money to the consumer upfront and does not necessarily provide a flat-rate subsidy. The contribution can be finely granulated, according to a number of criteria (e.g. insufficient means, encouraging energy savings, sustainability). The system is transparent and secure for all participants. Support criteria can be easily modified over time in smart contracts. The development team is led by Imre Kocsis (BME MIT) and includes (lecturers and students) László Gönczy, Attila Klenik, Gábor Magyar, Bertalan Zoltán Péter, Balázs Ádám Toldi (BME – MIT and TMIT departments), Ádám Nyikes, Lívia Réka Ónozó (MNB).

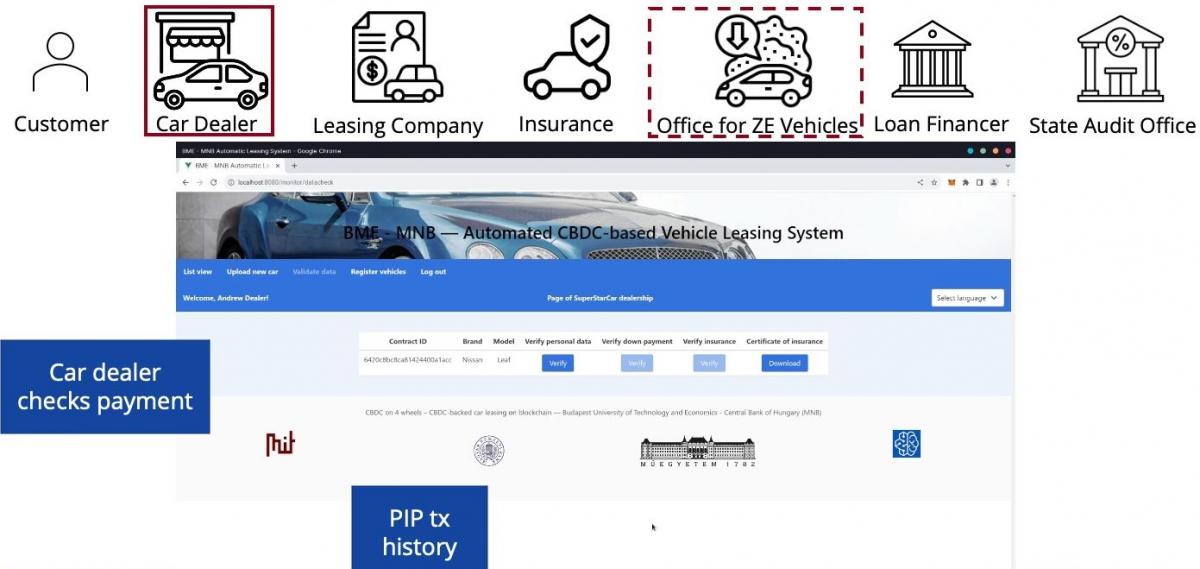

The other team have proposed a blockchain-based hypothetical auto-leasing solution to automate and thus simplify the leasing process, while also mainstreaming environmental concerns through real-time payment of targeted subsidies in central bank digital currencies. The entire vehicle leasing business process can be managed on a blockchain smart contract basis, from vehicle selection, through contracting, taking out the necessary insurance, possible loans and even applying for government subsidies (e.g. for an electric car), to auditing the process. The solution is also a possible future vision for a wide range of business transactions. In this implemented example, a well-regulated collaboration of several participants (customer, car dealer, leasing company, insurance company, etc.) is needed to successfully conclude a deal, and all this is done online, without multiple signed documents needing witnesses, in a secure way and with careful privacy (each stakeholder sees only as much data as is necessary for their role). The team was led by László Gönczy (BME MIT) and included (teachers and students) Bence Benyák, Ádám Csizmadia, Máté Debreczeni, Attila Frankó, Attila Klenik, Imre Kocsis, Gábor Magyar, Pál Varga (BME – MIT and TMIT departments), András Csonka (MNB).

After a pre-screening of the entries, both teams were shortlisted for the semi-finals, which were held for the top 22 teams. The team that proposed the energy price subsidy system was invited to the final of the top 12 teams, along with major technology giants such as Amazon, Thales, Revolut and Vayana Network.

MG – Rector’s Cabinet Communications Directorate